Shifting Demands: How the Pandemic Redefined Identity Verification Needs

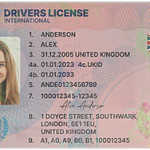

The rapid global shift to remote work, virtual healthcare, and online education during the pandemic created an urgent need for reliable, scalable identity verification systems. Before 2020, physical IDs—driver’s licenses, passports, or government-issued cards—remained the gold standard for proving identity. But as in-person interactions dwindled, institutions from banks to universities faced a critical question: *How do you confirm someone’s identity when you can’t see them face-to-face?*

This transition exposed gaps in traditional systems. A 2022 report by the Identity Theft Resource Center found that 63% of organizations struggled with verifying remote users, leading to increased fraud attempts. For example, healthcare providers processing telemedicine claims saw a 40% rise in identity-related fraud compared to pre-pandemic levels. These challenges forced a reevaluation of what “Real ID” means in a digital age—no longer just a physical card, but a dynamic, multi-layered system that balances security with user convenience.

Technology’s Role in Shaping the Next Generation of Real ID

Pandemic-driven demand accelerated the adoption of advanced technologies that were once considered niche. Here’s how innovation is redefining Real ID:

### 1. Biometric Integration Beyond Fingerprints

Facial recognition, voice authentication, and even behavioral biometrics (like typing patterns or mouse movement) now complement traditional methods. Financial institutions, for instance, use liveness detection—software that checks if a face scan comes from a live person rather than a photo or video—to prevent deepfake fraud. A 2023 study by Juniper Research predicts that biometric authentication will secure over 75% of global digital transactions by 2027, up from 45% in 2021.

### 2. Blockchain for Immutable Identity Records

Blockchain’s decentralized ledger system offers a way to store identity data securely without relying on a single authority. Estonia’s e-Residency program, which uses blockchain to manage digital identities, saw a 28% increase in applications during the pandemic as remote workers sought globally recognized credentials. By storing verified data (e.g., passport details, criminal records) on a blockchain, users can share specific information with third parties without exposing their entire identity profile.

### 3. AI-Powered Risk Assessment

Machine learning algorithms now analyze thousands of data points—device location, IP address, past behavior—to assess the “risk” of a user’s identity claim. For example, if a user logs into a banking app from a new device in a country they’ve never visited, AI flags the request for additional verification. This adaptive approach reduces friction for legitimate users while catching suspicious activity in real time.

User Expectations: Convenience vs. Privacy

Post-pandemic users expect seamless experiences. A 2024 survey by Accenture found that 81% of consumers will abandon a service if identity verification takes longer than 3 minutes. Yet, the same survey revealed that 78% worry about data misuse, creating a paradox: *How do you make verification fast without compromising security?*

Solutions are emerging in the form of “federated identity” systems, where users authenticate once (e.g., via a government-issued digital ID) and reuse that credential across multiple services. India’s Aadhaar system, which links 1.3 billion residents to a biometric ID, now integrates with over 2000 services—from mobile payments to tax filing—reducing the need for repeated verification. Similarly, the European Union’s Digital Identity Wallet, set to launch in 2025, will let citizens share verified data (like residency or professional licenses) with businesses or public services on a “need-to-know” basis.

Regulatory Changes: Balancing Innovation and Accountability

Governments worldwide are updating laws to keep pace with digital identity trends. In the U.S., the REAL ID Act of 2005, originally designed to strengthen physical ID requirements, now includes provisions for digital equivalents. The 2023 National Strategy for Critical Infrastructure Security and Resilience mandates that federal agencies adopt “identity-proofing standards” for remote access, pushing private sector partners to align their systems.

In the EU, the General Data Protection Regulation (GDPR) already imposes strict rules on data collection, but new legislation like the Digital Identity Regulation (DIR) adds layers specific to digital IDs. DIR requires that digital identity systems be “user-centric,” meaning individuals control which data they share and with whom. Such regulations aim to prevent the overcollection of personal information while fostering trust in digital verification tools.

Common Challenges and Actionable Solutions

As Real ID evolves, stakeholders face distinct obstacles. Below are five pressing issues and practical fixes:

#### 1. Problem: User Resistance to Biometric Data Collection

Many users hesitate to share biometric data (e.g., facial scans) due to privacy fears. A 2023 Pew Research poll found that 64% of Americans worry about biometric data being hacked.

**Solution:** Implement “consent-based” biometrics. Let users choose between biometric verification and alternative methods (e.g., one-time passwords or document uploads). Transparently explain how data is stored (e.g., encrypted, not shared with third parties) and provide easy access to delete or update biometric profiles.

#### 2. Problem: Cross-Border Verification Inconsistencies

A freelancer in Vietnam using a U.S. banking app may struggle to verify their identity if local ID systems don’t align with international standards.

**Solution:** Promote interoperable frameworks. Organizations like the International Telecommunication Union (ITU) are developing global identity standards (e.g., ITU-T Recommendation X.1254) that outline how digital IDs from different countries can interact. Adopting these standards allows systems to “speak the same language” when verifying cross-border users.

#### 3. Problem: Integration with Legacy Systems

Many institutions (e.g., older banks or government agencies) rely on outdated databases that can’t support modern verification tools.

**Solution:** Use API-based bridges. Application Programming Interfaces (APIs) act as intermediaries, allowing new verification software to pull data from legacy systems without overhauls. For example, a hospital with a 20-year-old patient database can use an API to cross-check a patient’s digital ID against stored records, avoiding costly system replacements.

#### 4. Problem: Accessibility for Vulnerable Populations

Elderly users or those with limited tech literacy may struggle with digital verification steps (e.g., app downloads or biometric scans).

**Solution:** Offer hybrid verification paths. Combine digital and physical methods—for example, let users verify via a video call with a live agent or submit a notarized physical ID alongside a digital form. The U.K.’s Verify service, which allows users to verify in-person at post offices or online, reduced exclusion rates among older adults by 32% in 2023.

#### 5. Problem: Scalability During High Demand

During peak times (e.g., tax season or benefit enrollment), verification systems may crash under traffic, frustrating users.

**Solution:** Invest in cloud-based, elastic infrastructure. Cloud platforms like AWS or Azure auto-scale computing resources based on demand, ensuring systems remain responsive even during surges. The Canadian government’s CRA MyAccount portal, which migrated to cloud infrastructure in 2022, handled 40% more traffic during the 2024 tax season without downtime.