Identity is a crucial aspect of modern – day life. It encompasses a wide range of information, from personal details like name and date of birth to financial and legal identifiers. One controversial and illegal item in the realm of identity is the fake ID card. While many people might associate fake ID cards with under – age drinking or other minor illegal activities, the potential consequences can be far more far – reaching, including possible impacts on one’s credit score. This article will explore in depth whether and how a fake ID card can affect your credit score.

The Nature of Fake ID Cards

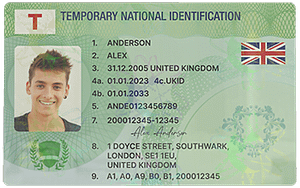

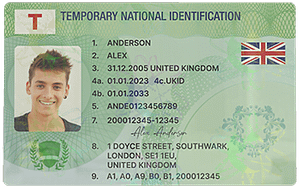

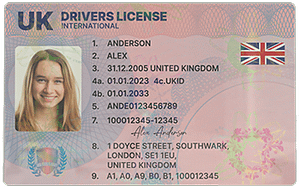

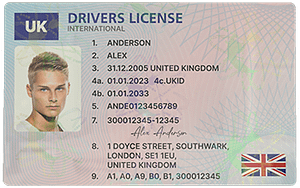

Fake ID cards are counterfeit documents that are designed to mimic legitimate identification. They can be created for various reasons, such as enabling minors to access age – restricted venues like bars and clubs, or for more serious illegal activities like fraud, identity theft, and evading law enforcement. These fake IDs often contain false personal information, whether it’s a fabricated name, date of birth, or even a fake address.

Using a fake ID card is illegal in most jurisdictions around the world. It violates laws related to forgery, fraud, and the improper use of identification documents. When caught with a fake ID, individuals can face significant legal penalties, including fines, community service, and in some cases, imprisonment.

How Credit Scores are Calculated

Before delving into the connection between fake ID cards and credit scores, it’s essential to understand how credit scores are calculated. Credit scores are numerical representations of an individual’s creditworthiness. They are used by lenders, such as banks and credit card companies, to assess the likelihood of a borrower repaying a loan or credit obligation on time.

The most common credit – scoring models, such as the FICO Score and VantageScore, take into account several key factors. Payment history is a major component, typically accounting for around 35% of the FICO Score. This includes whether you’ve made your credit card payments, loan payments, and other bills on time. The amount of debt you owe, known as credit utilization, makes up about 30% of the score. It measures the ratio of your outstanding balances to your credit limits.

Length of credit history is also important, contributing around 15% of the score. A longer credit history generally provides more data for lenders to assess your credit behavior. New credit, which refers to the number of new credit accounts you’ve opened recently, accounts for about 10% of the score. Finally, the types of credit you have, such as credit cards, mortgages, and auto loans, make up the remaining 10% of the score.

Direct Impact of Fake ID Cards on Credit Scores

There is no direct link between simply possessing or using a fake ID card and a negative impact on your credit score. Credit bureaus, such as Equifax, Experian, and TransUnion, do not consider the use of fake identification as a factor in their credit – scoring algorithms. Their focus is primarily on financial transactions, payment histories, and credit – related activities.

However, the illegal activities associated with fake ID cards can have an indirect but significant impact on credit scores. For example, if someone uses a fake ID to open a credit card or take out a loan fraudulently, it can have disastrous consequences for the victim’s credit. The fraudster might make purchases on the credit card and then fail to make payments, resulting in late payments, defaults, and ultimately a damaged credit score for the innocent party.

In such cases, the victim’s identity has been stolen through the use of the fake ID, and their credit profile is being misused. The credit card company or lender will report the non – payment and other negative activities to the credit bureaus, which will then reflect these on the victim’s credit report. This can lead to a significant drop in the credit score, making it difficult for the victim to obtain credit in the future, get approved for loans, or even rent an apartment.

Legal Consequences and Credit Score Indirectly

When an individual is caught with a fake ID card, the legal consequences can also have an indirect impact on their credit score. If the person is fined as part of their punishment, and they are unable to pay the fine on time, this can lead to a collection account being placed on their credit report.

Collection accounts are a major negative factor in credit scoring. When a debt goes unpaid and is sent to a collection agency, it is reported to the credit bureaus. This can cause a significant drop in the credit score, as collection accounts are seen as a sign of financial irresponsibility. Even if the individual eventually pays off the collection account, the negative mark can remain on their credit report for up to seven years, continuing to affect their creditworthiness.

Furthermore, if the individual is sentenced to imprisonment due to the use of a fake ID card, their ability to maintain regular financial obligations, such as credit card payments and loan repayments, can be severely hampered. Missing payments while in prison can lead to late payment penalties, defaults, and ultimately a damaged credit score.

Identity Theft and Fake ID Cards

Identity theft is a major concern when it comes to fake ID cards. Fraudsters can use fake IDs to steal the identities of others and engage in a wide range of illegal financial activities. They might open new credit accounts in the victim’s name, apply for loans, or make large purchases on existing credit cards.

Once the fraudster starts using the victim’s credit in an improper way, the victim may not be aware of the problem until it’s too late. By the time they notice unusual charges on their credit card statements or denials for credit applications they didn’t make, their credit score may already have been severely damaged.

To protect against identity theft related to fake ID cards, individuals should be vigilant about monitoring their credit reports. They can request a free credit report from each of the three major credit bureaus once a year. By reviewing their credit reports regularly, they can spot any unauthorized accounts or activities and take immediate action to correct them.

Steps to Take if Your Credit is Affected by Fake ID – Related Fraud

If you suspect that your credit has been affected by fraud related to a fake ID card, the first step is to contact the credit bureaus immediately. You can place a fraud alert on your credit report, which will notify potential lenders to take extra precautions when processing your credit applications.

You should also file a police report. Provide the police with all the details you have about the suspected fraud, including any information related to the fake ID card if available. The police report can be an important document when dealing with the credit bureaus and creditors.

Contact the creditors or financial institutions that are associated with the fraudulent accounts. Explain the situation to them and provide any evidence you have of the fraud. They may be able to freeze the accounts and remove the fraudulent charges from your credit report.

Finally, consider working with a credit – repair company or a consumer protection attorney. They can provide expert advice and assistance in dealing with the credit – reporting agencies and creditors to help you restore your credit.

Preventing Fake ID – Related Credit Issues

Prevention is always better than cure when it comes to fake ID – related credit issues. One of the most important steps is to safeguard your personal information. Be careful about sharing your identification details, such as your Social Security number, driver’s license number, and date of birth, only when it’s absolutely necessary.

Use strong passwords and two – factor authentication for your online accounts, especially those related to your finances. This can add an extra layer of security and make it more difficult for fraudsters to access your accounts.

Educate yourself about the signs of identity theft and fraud. Regularly review your bank statements, credit card statements, and other financial documents for any unusual or unauthorized transactions. If you notice anything suspicious, take immediate action.

Additionally, be cautious when using public Wi – Fi networks. Fraudsters can use these networks to intercept your personal information. If you need to access sensitive financial information while on a public network, consider using a virtual private network (VPN) to encrypt your connection.