Opening a bank account is a common – place financial activity for individuals to manage their money, save, and conduct various transactions. However, the question of whether one can use a fake ID card to open a bank account is both legally and ethically a resounding no.

Legal Consequences of Using a Fake ID Card to Open a Bank Account

Using a fake ID card to open a bank account is a serious criminal offense in most countries and regions. It falls under the category of identity fraud and forgery. Identity fraud involves the illegal use of someone else’s personal information or the creation of false identities for personal gain. Forgery, on the other hand, pertains to the act of creating or altering documents, such as ID cards, with the intent to deceive.

The penalties for these crimes can be severe. In many jurisdictions, individuals found guilty of identity fraud and forgery can face imprisonment, hefty fines, and a criminal record. A criminal record can have long – lasting impacts on a person’s life, including difficulties in finding employment, obtaining housing, and accessing certain services.

Bank’s ID Verification Procedures

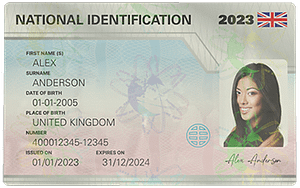

Banks have strict and multi – layer ID verification procedures in place to prevent fraud. When a customer applies to open a bank account, the bank will first check the physical ID card presented by the applicant. They will look for security features such as holograms, watermarks, and unique serial numbers. These security features are designed to be difficult to replicate, and banks are trained to spot any signs of forgery.

In addition to the physical inspection of the ID card, banks also cross – reference the information on the ID with various databases. They may check with government – issued identity databases, credit bureaus, and other reliable sources to verify the authenticity of the applicant’s identity. This cross – referencing helps to ensure that the person opening the account is who they claim to be and that the information provided is accurate.

Some banks may also use biometric verification methods, such as fingerprint or facial recognition, in addition to the ID card check. These biometric features add an extra layer of security and make it even more difficult for fraudsters to use fake ID cards to open accounts.

Risks and Dangers for the Person Using a Fake ID Card

Even if a person manages to successfully open a bank account using a fake ID card (which is highly unlikely), they will face numerous risks. First of all, if the bank discovers the fraud at any point, they will freeze the account immediately. This means that the person will not be able to access any of the funds in the account, and all transactions will be halted.

Secondly, once the bank reports the fraud to the relevant authorities, an investigation will be launched. The person using the fake ID card will be tracked down, and they will have to face the legal consequences as mentioned above. Moreover, if the fake ID card is associated with another individual’s real identity, the innocent person may also be affected, facing financial and legal troubles due to the fraudulent activity.

Alternative and Legal Ways to Open a Bank Account

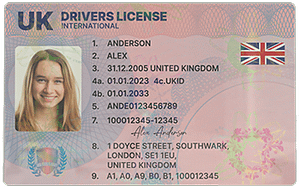

For individuals who are eligible to open a bank account, the process is straightforward and legal. To open a personal bank account, one typically needs to present a valid government – issued ID, such as a passport, driver’s license, or national identity card. In addition to the ID, the bank may also require proof of address, such as a utility bill or a lease agreement. Some banks may also ask for a minimum deposit to open the account.

For business accounts, the requirements are more comprehensive. In addition to the owner’s personal ID and proof of address, the business will need to provide documents such as the business registration certificate, tax identification number, and details of the business’s ownership structure. This ensures that the bank is dealing with a legitimate business entity and helps to prevent money – laundering and other illegal activities.

Common Problems and Solutions

1. Lost or Stolen ID Card While Trying to Open a Bank Account

Problem: An individual has lost their ID card or had it stolen just before they planned to open a bank account. Without a valid ID, the bank will not allow them to open an account.

Solution: The first step is to report the loss or theft of the ID card to the relevant authorities immediately. For a driver’s license, this may be the local department of motor vehicles; for a passport, it is the embassy or consulate. Once the report is filed, the individual can apply for a replacement ID. In the meantime, if they need to open a bank account urgently, some banks may accept alternative forms of identification, such as a birth certificate, social security card, and a utility bill with their name and address. However, this varies from bank to bank, and it is best to check with the specific bank in advance.

2. Incomplete ID Information

Problem: The ID card presented has some missing or unclear information, such as a faded name or an unclear address. This can cause issues during the bank’s ID verification process.

Solution: The individual should contact the issuing authority of the ID card to get the information corrected or updated. For example, if the name on the ID is misspelled, they can go to the government agency that issued the ID to have it corrected. In the case of an unclear address, they may need to provide additional proof of address to the bank, such as a recent tax return or a letter from a government agency with their correct address.

3. Difficulty in Proving Identity as a Non – Citizen

Problem: Non – citizens may face challenges in proving their identity when trying to open a bank account, especially if they do not have a local driver’s license or national identity card.

Solution: Non – citizens can present a valid passport as a primary form of identification. In addition, they may need to provide other documents such as a work permit, student visa, or a letter from their employer or educational institution. Some banks may also require a local contact person or a reference. It is advisable for non – citizens to research banks that are more experienced in dealing with non – citizen customers and may have more flexible identification requirements.

4. Delayed ID Verification Process

Problem: The bank’s ID verification process may take longer than expected, causing frustration for the applicant who wants to open the account quickly.

Solution: The applicant can contact the bank’s customer service to inquire about the status of the verification. In some cases, providing additional documentation or clarifying certain information can speed up the process. For example, if the bank is having trouble verifying the applicant’s address, providing a more recent utility bill or a notarized letter can help. It is also important to be patient as the bank is following strict procedures to ensure the security of its customers and prevent fraud.

5. Incorrect Information on Bank Application Forms

Problem: The applicant may fill out the bank account application form with incorrect information, which can lead to the rejection of the application or issues later on.

Solution: Before submitting the application form, the applicant should carefully review all the information filled in. If they notice any errors, they can correct them immediately. If the form has already been submitted and the bank has identified the incorrect information, the applicant should contact the bank as soon as possible to provide the correct details. In some cases, the bank may require the applicant to fill out a new application form or provide additional documentation to support the corrected information.