Government-issued identification has long served as a cornerstone for accessing services, from boarding flights to opening bank accounts. Over the past two decades, technological advancements have shifted how societies manage personal data, leading to the rise of digital tools designed to streamline these processes. At the heart of this transformation lies the intersection of Real ID—a federal standard for state-issued driver’s licenses and identification cards—and digital identity wallets, which aim to replace physical documents with secure, portable digital versions.

Understanding Real ID: A Foundation for Modern Identification

Enacted under the 2005 REAL ID Act, Real ID was created to address gaps in identity verification following security concerns in the early 2000s. The program established uniform security standards for state-issued IDs, requiring applicants to provide specific documentation: proof of identity (e.g., birth certificate or passport), Social Security number verification, two proofs of residential address, and evidence of name changes if applicable. By 2025, Real ID-compliant licenses will be mandatory for domestic air travel and accessing federal facilities, making them a critical component of daily life for U.S. residents.

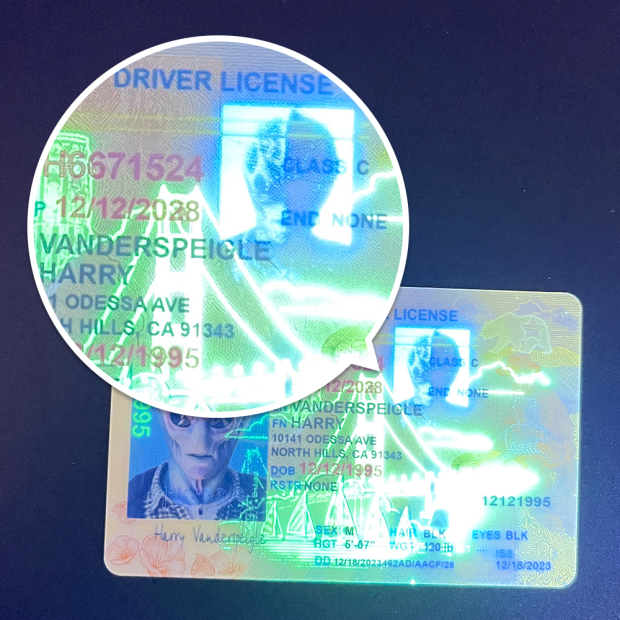

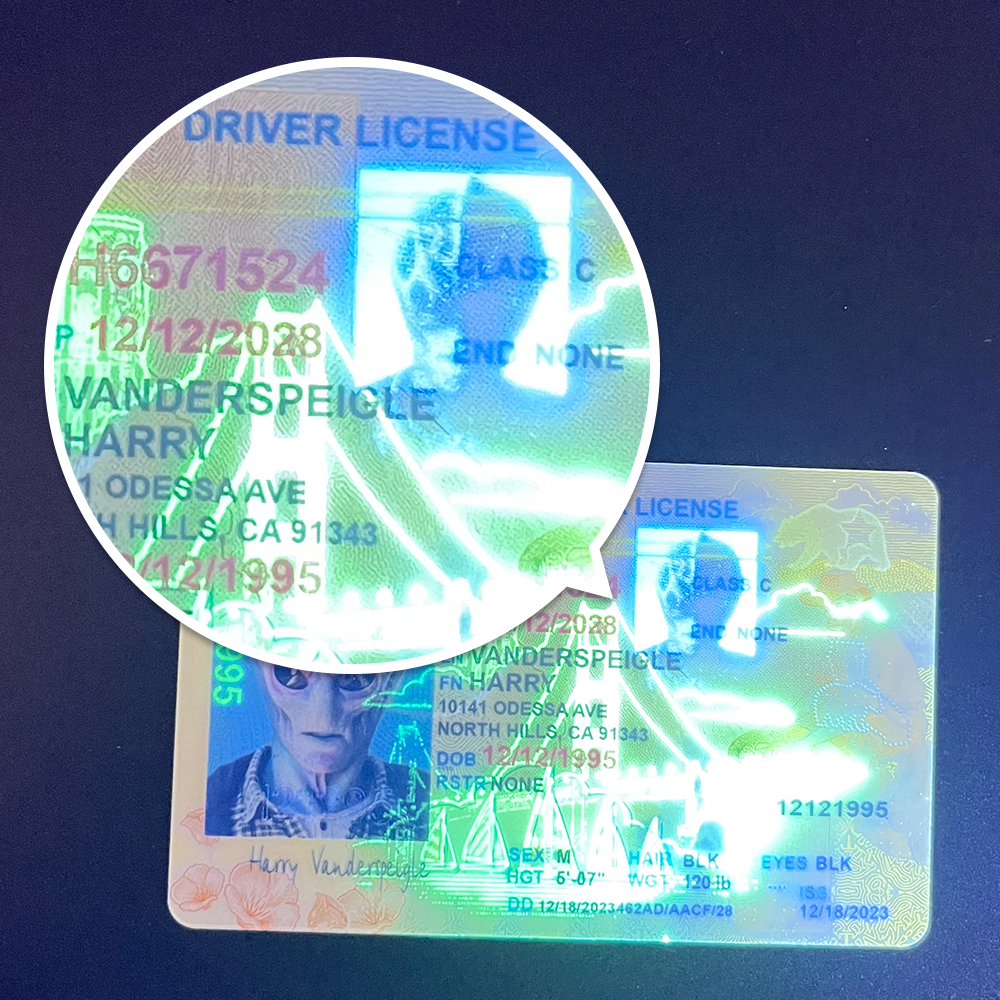

States have gradually adopted Real ID requirements, with varying timelines and implementation strategies. For example, California rolled out enhanced IDs in 2016, while Texas began full compliance in 2021. Each state’s ID includes security features like holographic overlays, laser-engraved images, and machine-readable zones (MRZs) to prevent counterfeiting. These physical safeguards laid the groundwork for discussions about how digital formats could expand their utility.

Digital Identity Wallets: Redefining Access to Credentials

A digital identity wallet is a software application—typically mobile—that stores and manages digital versions of personal documents. Unlike physical wallets, these tools use encryption, biometric authentication (e.g., fingerprint or facial recognition), and secure storage protocols to protect sensitive data. Users can share specific credentials with third parties (e.g., airlines, banks) via QR codes, near-field communication (NFC), or direct API connections, reducing the need to carry physical IDs.

Examples of early adopters include Apple Wallet, which allows users to store driver’s licenses in select states, and Google Wallet, which integrates with state-issued digital IDs. Beyond consumer apps, government initiatives like Estonia’s national digital identity system (ID-card) demonstrate how digital wallets can support everything from voting to healthcare access. These systems prioritize user control, enabling individuals to decide which data to share and with whom.

The Synergy of Real ID and Digital Wallets

Integrating Real ID with digital wallets bridges the gap between physical security standards and modern convenience. By digitizing Real ID-compliant credentials, users gain a single, portable tool to access federal and state services. For instance, a traveler could use their digital wallet to present a Real ID at airport security, eliminating the need to carry a physical license. Similarly, a student could share a digital ID with a university to verify enrollment, streamlining administrative processes.

Technical integration relies on standards like ISO/IEC 18013-5 (a global framework for digital driver’s licenses) and W3C Verifiable Credentials (a specification for tamper-evident digital documents). These protocols ensure that digital Real IDs are interoperable across platforms and jurisdictions, preventing fragmentation. States like Arizona and Georgia have already piloted programs where residents can add Real ID-compliant licenses to Apple Wallet, with plans to expand to other devices and services.

Key Considerations for Widespread Adoption

While the benefits of integration are clear, several challenges must be addressed to ensure success:

- Privacy Protection: Storing sensitive data digitally increases the risk of breaches. Solutions include end-to-end encryption, zero-knowledge proofs (which verify data without revealing it), and strict access controls.

- Interoperability: States use different systems to issue Real IDs, creating inconsistencies in digital formats. Federal guidelines for API (Application Programming Interface) compatibility could standardize data exchange.

- User Trust: Many individuals remain skeptical of digital tools handling critical documents. Transparent communication about security measures and gradual rollouts (starting with non-critical use cases) can build confidence.

- Device Accessibility: Not all users own smartphones or reliable internet. Hybrid systems—allowing both physical and digital ID presentation—ensure inclusivity.

- Regulatory Alignment: Laws like the GDPR (EU) and CCPA (California) impose strict rules on data handling. Integrating Real ID with digital wallets requires compliance with these regulations to avoid legal risks.

5 Common Problems & Solutions in Integration

As Real ID and digital wallets converge, users and providers often encounter specific hurdles. Below are actionable solutions to these challenges:

1. “I’m worried about my data being stolen from a digital wallet.”

Problem: Users fear that storing sensitive IDs digitally increases vulnerability to hacking or phishing attacks.

Solution: Implement multi-layered security. Digital wallets should use AES-256 encryption (military-grade) for data storage, biometric authentication (e.g., fingerprint or facial recognition) for access, and tokenization (replacing real IDs with non-sensitive tokens during transactions). For example, Apple Wallet’s Secure Enclave chip isolates biometric data from the main device processor, reducing breach risks.

2. “My state’s Real ID doesn’t work with my digital wallet app.”

Problem: Inconsistent technical standards between states and wallet providers limit cross-platform use.

Solution: Adopt global interoperability frameworks. The International Civil Aviation Organization (ICAO) recommends using 2D barcodes compliant with Doc 9303 standards for digital IDs. States can also partner with wallet providers to develop APIs that translate state-specific data formats into universal standards, ensuring compatibility across apps like Google Wallet and Samsung Pay.

3. “I don’t trust digital IDs for important tasks like flying.”

Problem: Users perceive physical IDs as more reliable for critical services like airport security.

Solution: Pilot programs with clear success metrics. For example, the Transportation Security Administration (TSA) could run trials where 10% of passengers use digital IDs, tracking verification times and error rates. Publishing positive results (e.g., “98% of digital ID checks completed in under 30 seconds”) can reassure skeptics. Additionally, allowing users to present both physical and digital IDs during a transition period eases adoption.

4. “Older adults or low-income users might not have smartphones.”

Problem: Digital exclusion risks marginalizing populations without access to modern devices.

Solution: Develop hybrid systems. For instance, states could issue physical smart cards (with embedded chips) that work alongside digital wallets. These cards could be scanned at checkpoints using NFC readers, offering a tech-neutral option. Community centers and libraries could also provide free device training to help users become comfortable with digital tools.

5. “How do I recover my digital ID if I lose my phone?”

Problem: Device loss or damage could render digital IDs inaccessible.

Solution: Implement backup and recovery protocols. Users could register a secondary device (e.g., a partner’s phone) or a secure cloud storage service (encrypted with a unique recovery key) to restore credentials. Some wallets, like those used in Estonia’s system, allow users to reset access via a government portal after verifying identity through a trusted third party (e.g., a bank).

By addressing these challenges, the integration of Real ID with digital wallets can create a more efficient, secure, and inclusive identity verification ecosystem. As technology evolves, the line between physical and digital identification will continue to blur, with the ultimate goal of empowering users to manage their identities safely and conveniently in an increasingly connected world.