### Introduction

In today’s financial – centered society, managing personal identification and investment – related information is of utmost importance. A Real ID is a crucial form of identification, and understanding how to update investment information associated with it can have significant implications for an individual’s financial well – being and compliance.

### What is a Real ID?

A Real ID is a state – issued driver’s license or identification card that complies with the requirements set by the Real ID Act of 2005. This act was passed in response to the September 11, 2001, terrorist attacks to enhance security and standardize identification documents across the United States.

– **Security Features**: Real IDs come with a variety of security features to prevent fraud. These include holographic images, microprinting, and embedded chips. For example, the holographic image on a Real ID is a three – dimensional representation that is difficult to replicate, adding an extra layer of security.

– **Acceptance**: Starting from a certain date, a Real ID is required for certain federal activities such as boarding a domestic flight (within the U.S.) or entering federal facilities. If you do not have a Real ID, you may need to present an alternative form of acceptable identification, such as a U.S. passport.

### Why Update Investment Information on Your Real ID?

There are several reasons why it is necessary to update investment information on your Real ID:

– **Accuracy**: As your personal and financial situation changes, it is essential to keep your investment information up – to – date. For instance, if you change your address, contact information, or investment preferences, your investment firm needs to have the most current data. This ensures that you receive important communications, such as statements, notifications about investment opportunities, and tax – related documents in a timely manner.

– **Compliance**: Financial regulatory bodies often require investment firms to maintain accurate client information. By updating your investment information on your Real ID, you are helping your investment firm stay in compliance with these regulations. Failure to do so may result in restrictions on your investment activities or potential legal issues.

– **Security**: Keeping your investment information current also enhances security. If an unauthorized person gains access to outdated information, it could potentially lead to identity theft or unauthorized access to your investment accounts. By regularly updating your information, you can reduce these risks.

### The Process of Updating Investment Information on Your Real ID

#### Step 1: Gather Required Documents

Before starting the process of updating investment information, you need to gather the necessary documents. This typically includes your Real ID, proof of the change (such as a utility bill for an address change or a legal document for a name change), and any relevant investment – related documents. For example, if you are changing your investment strategy, you may need to provide documentation from your financial advisor or investment firm.

– **Identity Verification**: The investment firm will use your Real ID to verify your identity. Make sure your Real ID is valid and has not expired. If it has expired, you should first renew it at your local Department of Motor Vehicles (DMV) before attempting to update your investment information.

#### Step 2: Contact Your Investment Firm

Once you have gathered the required documents, the next step is to contact your investment firm. You can do this through various channels, such as:

– **Phone**: Call the customer service number provided by your investment firm. Be prepared to provide your personal information, account number, and details of the change you want to make. The customer service representative will guide you through the process and may ask for additional information or documentation.

– **Online Portal**: Many investment firms have an online portal where you can log in and update your information. Log in to the portal using your username and password. Navigate to the section for account information or profile settings and follow the instructions to make the necessary changes. You may be required to upload scanned copies of the supporting documents.

– **In – Person**: If you prefer, you can visit a local branch office of your investment firm. Bring all the required documents with you. A representative at the branch will assist you in updating your investment information and verifying the documents.

#### Step 3: Provide Updated Information

When you contact your investment firm, you will need to provide the updated information. This may include:

– **Personal Information**: Update your name, address, phone number, and email address if any of these have changed. Make sure to double – check the accuracy of the information before submitting it.

– **Investment Preferences**: If you have changed your investment goals, risk tolerance, or investment strategy, inform your investment firm. They may require you to fill out additional forms or provide a written statement explaining the changes.

– **Beneficiary Information**: If you have added, removed, or changed the beneficiaries of your investment accounts, provide the relevant details. This is an important aspect of estate planning and ensuring that your assets are distributed according to your wishes.

#### Step 4: Document Submission

As mentioned earlier, you may need to submit supporting documents to verify the changes. The types of documents required will depend on the nature of the change:

– **Address Change**: A recent utility bill, bank statement, or lease agreement with your new address can be used as proof.

– **Name Change**: If you have legally changed your name (such as through marriage or divorce), you will need to provide a copy of the marriage certificate, divorce decree, or court – issued name change document.

– **Investment Strategy Change**: If you are changing your investment strategy, you may need to provide a letter from your financial advisor or a self – written statement outlining the new strategy.

#### Step 5: Verification and Confirmation

After you have provided the updated information and submitted the required documents, your investment firm will verify the information. This may involve cross – checking with other sources or contacting you for further clarification if needed. Once the verification is complete, you will receive a confirmation of the update. This confirmation may be in the form of an email, letter, or a notification within the online portal.

### Common Problems and Solutions

#### Problem 1: Difficulty in Gathering Required Documents

– **Description**: Sometimes, it can be challenging to find or obtain the necessary documents for updating investment information. For example, if you have lost your marriage certificate and need it to prove a name change, or if you cannot locate an old utility bill for an address change.

– **Solution**: In the case of a lost marriage certificate, you can contact the county clerk’s office where the marriage took place to request a copy. For lost utility bills, you can contact your utility provider and ask for a re – issuance of a past bill. Some utility providers also allow you to access and download old bills from their online portals.

#### Problem 2: Technical Issues with the Online Portal

– **Description**: When trying to update information through the investment firm’s online portal, you may encounter technical glitches such as slow loading times, error messages when uploading documents, or problems logging in.

– **Solution**: First, try clearing your browser cache and cookies. If the problem persists, contact the investment firm’s technical support. They can guide you through the troubleshooting process or provide an alternative method for updating your information, such as using a different browser or accessing the portal from a different device.

#### Problem 3: Long Wait Times When Contacting Customer Service

– **Description**: When calling the investment firm’s customer service number, you may experience long wait times, especially during peak hours or when there are high call volumes.

– **Solution**: Try calling during off – peak hours, such as early in the morning or late in the afternoon. You can also check if the investment firm has a chat – based customer service option on their website. Chat services may offer a more immediate response compared to phone calls.

#### Problem 4: Incomplete Understanding of Investment Information Changes

– **Description**: You may not fully understand the implications of changing certain investment information, such as how a change in risk tolerance will affect your portfolio or how to properly update your beneficiary information.

– **Solution**: Schedule a consultation with your financial advisor. They can explain the implications of different investment information changes and guide you through the process. You can also request educational materials from your investment firm, such as brochures or online resources, to better understand these concepts.

#### Problem 5: Delayed Confirmation of Update

– **Description**: After submitting the updated information and documents, you may not receive a confirmation of the update in a timely manner.

– **Solution**: First, check the investment firm’s communication channels, such as your email spam folder or the notifications section of the online portal. If you still do not see a confirmation, contact the investment firm’s customer service to inquire about the status of your update. They can provide you with an estimated time for completion and any additional steps that may be required.

#### Problem 6: Inconsistent Information Across Different Systems

– **Description**: There may be a situation where the updated information in your investment account does not match the information on your Real ID or other related systems, such as your bank account linked to the investment account.

– **Solution**: Contact both the investment firm and the other relevant institution (such as the bank). Provide them with the correct information and ask them to synchronize their systems. Keep a record of all communication, including dates, names of representatives, and details of the conversation, in case further follow – up is needed.

#### Problem 7: Lack of Clarity on Regulatory Requirements

– **Description**: You may be unsure about the specific regulatory requirements related to updating investment information on your Real ID, especially if you are making significant changes such as changing your investment strategy or adding new beneficiaries.

– **Solution**: Consult a legal or financial expert who is well – versed in investment regulations. You can also refer to the official websites of financial regulatory bodies, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA), for detailed information on the requirements.

#### Problem 8: Difficulty in Communicating Complex Changes

– **Description**: If you are making complex changes to your investment information, such as a multi – step change in your investment portfolio structure, it may be difficult to communicate these changes clearly to the investment firm’s representatives.

– **Solution**: Prepare a written summary of the changes in advance, including the reasons for the changes and any relevant details. During your communication with the investment firm, provide this summary and be prepared to answer any questions they may have. You can also request a follow – up communication, such as an email or a written confirmation, to ensure that both parties are on the same page.

#### Problem 9: Security Concerns During the Update Process

– **Description**: You may be worried about the security of your personal and investment information during the update process, especially when submitting documents online or over the phone.

– **Solution**: Ensure that the investment firm has proper security measures in place. This includes using secure websites (look for the “https” in the website URL), encrypting data transmission, and having strict access controls for employee access to your information. If you have concerns, ask the investment firm about their security policies and procedures.

#### Problem 10: Language Barriers

– **Description**: If you are not fluent in the language used by the investment firm’s customer service or communication channels, it can be difficult to understand the instructions and complete the update process accurately.

– **Solution**: Check if the investment firm offers multilingual customer service. If not, you can consider using a translation service or asking a bilingual friend or family member to assist you. Some investment firms also provide translated versions of important documents and instructions on their websites.

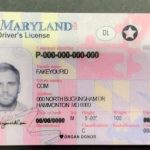

Fake ID Pricing

unit price: $109

| Order Quantity | Price Per Card |

|---|---|

| 2-3 | $89 |

| 4-9 | $69 |

| 10+ | $66 |