Section: Introduction

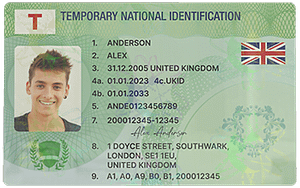

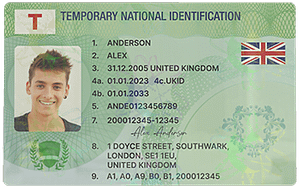

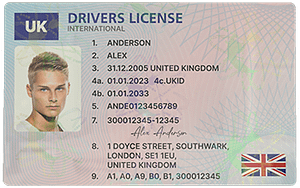

Your identity card is a crucial and highly – sensitive personal document. It contains a wealth of personal information, from your name and date of birth to your address and sometimes even biometric data. Lending this card to someone who has the potential to make a fake copy can have far – reaching and often negative consequences. It’s not just about the act of lending; it’s about the malicious use that can stem from a fake copy being created.

Section: Types of Malicious Activities with a Fake ID Copy

Financial Fraud

One of the most common and dangerous risks is financial fraud. With a fake copy of your ID card, an individual could potentially open bank accounts in your name. They might apply for credit cards, take out loans, or engage in other financial transactions. For example, they could use the fake ID to convince a bank that they are you and obtain a large – sum loan. When the loan defaults, it is your credit score that will be severely affected. You may find yourself in a situation where you are suddenly burdened with debts that you never incurred, and it can take months or even years to clear your name and repair your credit.

Identity Theft for Criminal Activities

Criminals may use a fake copy of your ID card to commit crimes. If they are caught during the commission of a crime and present your fake ID, you could be wrongly implicated in criminal activities. For instance, if someone uses your fake ID to buy illegal drugs or engage in prostitution, law enforcement may initially believe that you are the perpetrator. This can lead to a long and stressful legal process as you try to prove your innocence. You may have to attend court hearings, provide alibis, and go through a series of investigations to clear your name.

Access to Sensitive Services and Information

A fake ID copy can also be used to gain access to sensitive services and information. For example, in some cases, it could be used to access government – related services such as social security benefits or healthcare services. If someone uses your fake ID to claim social security benefits that you are entitled to, it can disrupt your own access to those benefits. Additionally, they could use it to access your personal medical records, which is a serious violation of your privacy rights.

Section: Legal Implications

Your Own Liability

Even though you may not have intended for the fake copy to be made, lending your ID card can potentially make you liable in some legal situations. In some jurisdictions, if it is found that you negligently lent your ID card to someone who then made a fake copy, you could face legal penalties. This could range from fines to more severe consequences depending on the nature and extent of the damage caused by the fake ID. For example, if the fake ID is used in a major financial fraud operation and it is determined that your act of lending the card contributed to the situation, you may be held partially responsible.

Legal Process for Clearing Your Name

If you become a victim of fraud or identity theft as a result of a fake ID copy made from your lent card, the legal process to clear your name can be complex and time – consuming. You will likely need to file police reports, gather evidence to prove your innocence, and work with financial institutions and other relevant authorities. For example, if your credit has been damaged due to fraudulent activities, you will need to dispute the inaccurate information with credit bureaus, provide them with documentation to support your claim, and follow up regularly to ensure that your credit report is corrected.

Section: How to Protect Yourself

Never Lend Your ID Card

The most straightforward way to avoid the risks associated with a fake ID copy is to never lend your ID card. No matter how trustworthy the person may seem or what the reason they give for needing it, it’s not worth the potential risks. Remember, your ID card is a key to your identity, and once it’s in the wrong hands, it can be misused in ways you may not even anticipate.

Report Loss or Theft Immediately

If your ID card is lost or stolen, report it immediately to the relevant authorities. This includes the local police department and the issuing agency of the ID card (such as the DMV for a driver’s license). By reporting it promptly, you can limit the potential for someone to use it to make a fake copy or engage in other malicious activities. When you report it, get a copy of the police report, which can be useful if any issues arise in the future.

Monitor Your Accounts Regularly

Regularly monitor your bank accounts, credit card statements, and other financial accounts for any suspicious activities. Look for any unauthorized transactions, such as withdrawals, purchases, or account openings. If you notice anything out of the ordinary, contact your financial institution immediately. You can also sign up for credit monitoring services, which will alert you if there are any significant changes to your credit report, such as new credit applications in your name.

Section: Common Problems and Solutions

Problem 1: I lent my ID card before knowing the risks. What should I do?

Solution: First, contact the person you lent the card to and demand its immediate return. If they refuse or you suspect they have already made a fake copy, report the situation to the local police. Provide them with all the details you know, such as when and why you lent the card. Also, start monitoring your financial accounts and credit report for any signs of suspicious activity. You may need to place a fraud alert on your credit report, which will notify potential creditors to take extra steps to verify your identity before extending credit.

Problem 2: I suspect that a fake copy of my ID card has been made, but I don’t have proof.

Solution: Even without concrete proof, you can still take preventive measures. Contact your bank and other financial institutions to inform them of your suspicion. They can put additional security measures in place, such as requiring additional verification for any transactions. You can also freeze your credit report, which will prevent anyone from opening new credit accounts in your name. Additionally, file a police report stating your concerns. The police may be able to investigate further and look for any signs of illegal activity related to the potential fake ID.

Problem 3: I am being wrongly accused of a crime because of a fake ID copy.

Solution: The first step is to cooperate fully with the law – enforcement authorities. Provide them with any evidence that can prove your innocence, such as alibis, witness statements, or documentation of your whereabouts at the time of the alleged crime. Hire a lawyer who specializes in identity – theft and criminal defense cases. They can guide you through the legal process, represent you in court, and help you clear your name. It’s also important to keep records of all communication with the police, lawyers, and other relevant parties.

Problem 4: My credit score has been damaged due to fraudulent activities related to a fake ID copy.

Solution: Start by disputing the inaccurate information on your credit report with the credit bureaus. You can do this by sending a written dispute letter that clearly states which items on the report are incorrect and provide any supporting documentation, such as police reports or statements from financial institutions. Follow up with the credit bureaus regularly to ensure that they are investigating your dispute. You may also need to work with the financial institutions that reported the incorrect information to correct the records. In addition, consider working with a credit – repair agency, but be sure to research and choose a reputable one.

Problem 5: I received a notice of a debt that I didn’t incur, likely due to a fake ID copy.

Solution: Contact the creditor immediately and explain the situation. Provide them with any evidence that you have, such as a police report if you have filed one. Request that they provide you with detailed information about the debt, including when it was incurred and what it was for. If the creditor is uncooperative or refuses to believe your claim, consider sending a letter via a lawyer. You can also report the creditor to the Consumer Financial Protection Bureau if they engage in unfair or deceptive practices during the process of dealing with the wrongly – attributed debt.