Banks play a crucial and multi – faceted role in the identification and reporting of fake ID cards. In the financial landscape, the authenticity of customer identification is of utmost importance as it safeguards the integrity of financial transactions, protects the interests of customers and the bank itself, and helps in combating various forms of fraud and illegal activities.

Importance of Identifying Fake ID Cards in Banks

First and foremost, customer onboarding is a key area where banks need to be vigilant. When a new customer approaches a bank to open an account or avail of other financial services, the bank is required to verify the identity of the individual. This is not only a regulatory requirement but also a fundamental aspect of risk management. If a bank were to accept a customer with a fake ID card, it could lead to a host of problems. For example, the imposter could use the account for money laundering, identity theft, or other illegal financial activities. This could result in significant financial losses for the bank, damage to its reputation, and legal consequences.

Moreover, in the case of lending operations, banks rely on the accurate identity of the borrower. A fake ID card could mean that the bank is lending money to someone who has no intention or ability to repay the loan. This not only affects the bank’s financial health but also distorts the overall credit market.

Methods Used by Banks to Identify Fake ID Cards

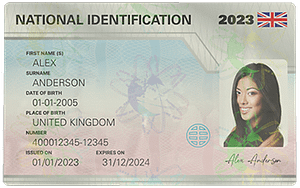

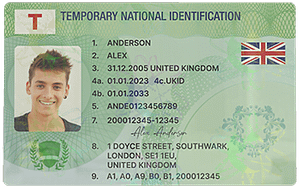

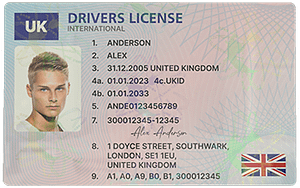

Visual Inspection: One of the most basic yet important methods is visual inspection. Bank employees are trained to carefully examine the physical characteristics of an ID card. This includes looking at the quality of the printing, the texture of the card, and the presence of security features. For example, genuine ID cards often have holograms, watermarks, or special inks that are difficult to replicate. A fake ID card may have poor – quality printing, smudged images, or missing security features.

Verification of Information: Banks also cross – check the information on the ID card with other reliable sources. For instance, they may verify the address on the ID card with the information in public records or check the identity number against government databases. If there are discrepancies in the information, it could be a sign of a fake ID card. For example, if the name on the ID card does not match the name associated with the address in public records, it warrants further investigation.

Use of Technology: In the modern age, banks are increasingly relying on technology to identify fake ID cards. Biometric verification systems, such as fingerprint or facial recognition, are being integrated into the customer identification process. These technologies compare the biometric data of the customer with the data stored in the ID card or in the bank’s database. If there is a mismatch, it indicates a potential problem. Additionally, some banks use document verification software that can detect signs of tampering or forgery on ID cards, such as irregularities in the magnetic stripe or the chip.

The Process of Reporting Fake ID Cards

Once a bank suspects that an ID card is fake, it has a legal and ethical obligation to report it. The first step is usually to inform the appropriate internal department, such as the security or fraud prevention unit. These departments will then conduct a more in – depth investigation. They may review surveillance footage, if available, to see if there are any other suspicious activities related to the individual presenting the fake ID card.

After the internal investigation, the bank is required to report the matter to the relevant law enforcement agencies. This could be the local police or specialized fraud investigation units. The bank provides all the relevant information it has gathered, including details about the customer who presented the fake ID card, the circumstances under which it was presented, and the results of its own investigation. This information is crucial for law enforcement agencies to track down the individuals involved in the production and use of fake ID cards and to prevent further illegal activities.

Collaboration with Other Entities

Banks do not operate in isolation when it comes to identifying and reporting fake ID cards. They often collaborate with other financial institutions, regulatory bodies, and law enforcement agencies. Information sharing among banks can be extremely valuable. For example, if one bank discovers a new type of fake ID card or a particular modus operandi used by fraudsters, it can share this information with other banks. This way, all banks can be on the lookout for similar fake ID cards and take appropriate preventive measures.

Regulatory bodies play a guiding role in setting standards and requirements for customer identification and the reporting of fake ID cards. Banks work closely with these bodies to ensure compliance with regulations. Law enforcement agencies, on the other hand, rely on banks to provide them with leads and evidence related to fake ID card cases. In turn, law enforcement agencies can share intelligence with banks about emerging trends in fake ID card production and usage, enabling banks to update their identification and prevention measures.

Common Problems and Solutions

Problem 1: Sophisticated Forgeries

With the advancement of technology, fake ID cards are becoming more sophisticated, making them harder to detect through visual inspection alone. Fraudsters are using high – quality printers and materials to replicate security features.

Solution: Banks need to continuously update their employee training programs to keep them informed about the latest trends in fake ID card forgeries. Additionally, investing in advanced technology such as high – resolution scanners and document authentication devices can help in detecting even the most sophisticated fakes. These devices can analyze the microscopic details of an ID card, such as the pattern of the paper fibers or the composition of the inks used.

Problem 2: Data Privacy Concerns in Verification

When cross – checking customer information against various databases, there are often data privacy concerns. Customers may be reluctant to have their personal information accessed and shared, and banks need to ensure that they are complying with strict data protection regulations.

Solution: Banks should implement clear and transparent data privacy policies. They should inform customers about the purpose of the information verification, which databases will be accessed, and how the data will be protected. Using anonymization and encryption techniques can also safeguard customer data during the verification process. Additionally, banks should only access the necessary information required for identity verification and not overstep the boundaries of data privacy.

Problem 3: Delays in Reporting

Sometimes, there may be delays in reporting a suspected fake ID card to law enforcement agencies. This could be due to internal processes, lack of awareness, or confusion about the reporting procedures.

Solution: Banks should establish clear and streamlined reporting procedures. Employees should be trained on these procedures so that they know exactly what to do when they suspect a fake ID card. Regular internal audits can also ensure that the reporting process is being followed promptly. Additionally, banks can set up a dedicated hotline or online reporting system for employees to report suspected fake ID card cases quickly and easily.

Problem 4: Inadequate Information Sharing

Despite the importance of information sharing among banks, regulatory bodies, and law enforcement agencies, there may be barriers to effective sharing. This could be due to differences in data formats, security concerns, or lack of communication channels.

Solution: Establishing common data standards and secure communication platforms can facilitate information sharing. Regulatory bodies can play a role in setting these standards and ensuring that all parties comply. Banks, law enforcement agencies, and regulatory bodies should also engage in regular joint training and awareness – building programs to improve communication and cooperation. For example, they can organize workshops on how to share information effectively while maintaining data security.

Problem 5: Over – Reliance on Technology

While technology is a valuable tool in identifying fake ID cards, over – reliance on it can be a problem. Technical glitches, system failures, or the development of counter – measures by fraudsters to bypass technology can lead to false negatives or positives.

Solution: Banks should adopt a multi – pronged approach that combines technology with human expertise. Employees should not solely rely on technology but also use their training and experience in visual inspection and information verification. Regular maintenance and updates of technology systems can also minimize the risk of technical failures. Additionally, banks should conduct regular reviews of their technology – based identification methods to ensure that they are still effective against emerging threats.