Banks play a crucial and multi – faceted role in the identification of fake ID cards. In the realm of financial services, the accurate verification of customers’ identities is of utmost importance for several reasons. First and foremost, it is a matter of compliance with various laws and regulations. Anti – money laundering (AML) and know – your – customer (KYC) regulations require banks to ensure that they are dealing with legitimate customers whose identities can be properly authenticated.

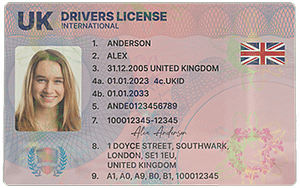

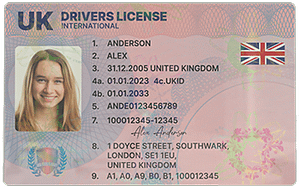

One of the primary ways banks identify fake ID cards is through visual inspection. Trained bank staff are taught to look for a variety of tell – tale signs. For example, they check the quality of the card’s printing. Genuine ID cards typically have high – quality printing with sharp, clear images and text. On the other hand, fake ID cards may have blurry or smudged prints, or the colors may appear off. The texture of the card is also a key factor. Real ID cards often have a specific feel to them, whether it’s a smooth finish or a slightly textured surface in certain areas. Fake cards may be made from sub – standard materials that feel different to the touch.

Banks also pay attention to the security features on ID cards. Most modern legitimate ID cards come with a range of security elements such as holograms, watermarks, and microprinting. Holograms are three – dimensional images that are difficult to replicate. When inspected, a genuine hologram will display different colors and patterns depending on the angle of view. Watermarks are visible when the card is held up to the light and should match the overall design and security requirements of the card. Microprinting, which is text that is extremely small and can only be seen under magnification, is another important security feature. Fake ID cards may either lack these security features or have poor imitations of them.

In addition to visual inspection, banks may also use technology to assist in the identification of fake ID cards. Some banks have ID card scanners that can read the magnetic stripe or the chip on the card (if present). These scanners can verify the data stored on the card against the information presented on the face of the card. For example, the name, date of birth, and ID number on the card should match the data read from the magnetic stripe or chip. If there are discrepancies, it could be a sign of a fake ID card. Biometric technologies are also being increasingly used in the banking industry. Fingerprint or facial recognition can be used in combination with ID card verification. If the biometric data of the customer does not match the data associated with the ID card, it raises a red flag for the bank.

The role of banks in identifying fake ID cards also extends to cross – referencing information. Banks may check the ID card details against their own internal databases as well as external databases. For example, they may verify the ID number with the relevant government agencies or identity verification services. If the ID number is not recognized or if there are any irregularities in the associated data, it could indicate a fake ID card. This cross – referencing is not only important for preventing fraud in the banking context but also for maintaining the integrity of the overall financial system.

Banks also play a role in educating their staff about the latest trends in fake ID card production and detection. The counterfeiting industry is constantly evolving, and new techniques are being developed to create more convincing fake ID cards. By keeping their staff updated on these trends, banks can better equip them to identify fake cards. Training programs may include sessions on new security features, emerging counterfeiting techniques, and the use of advanced identification technologies.

Common Problems and Solutions in Identifying Fake ID Cards

1. Inadequate Staff Training

Problem: Bank staff may not be properly trained to identify the latest fake ID card features. As counterfeiting techniques become more sophisticated, untrained or under – trained staff may miss important signs of a fake ID card. For example, new types of hologram imitations may be difficult to detect without proper training.

Solution: Regular and comprehensive training programs should be implemented. These programs should cover the latest security features of genuine ID cards, emerging counterfeiting techniques, and how to use identification technologies effectively. Training should also include hands – on practice with both real and fake ID cards to give staff practical experience.

2. Outdated Identification Technologies

Problem: Banks may be using old – fashioned ID card scanners or other identification technologies that are unable to detect the latest types of fake ID cards. For instance, some scanners may not be able to read certain new types of magnetic stripes or chips used in modern ID cards, or they may not be able to detect advanced hologram imitations.

Solution: Banks should invest in up – to – date identification technologies. This includes regularly upgrading ID card scanners and biometric devices. They should also keep an eye on emerging technologies in the field of identity verification and be willing to adopt new and more effective tools as they become available.

3. Database Inconsistencies

Problem: When cross – referencing ID card details with internal or external databases, there may be inconsistencies in the data. For example, the data in the bank’s internal database may be out of date, or there may be errors in the external databases that the bank relies on for verification. This can lead to false positives or false negatives in the identification of fake ID cards.

Solution: Banks should regularly update their internal databases to ensure the accuracy of customer information. They should also work with reliable external database providers and have processes in place to check for and correct any data discrepancies. Additionally, they can implement data validation algorithms to flag any suspicious or inconsistent data during the cross – referencing process.

4. High – Quality Counterfeits

Problem: Some fake ID cards are of extremely high quality, making them difficult to distinguish from genuine ones. These high – quality counterfeits may have convincing imitations of security features such as holograms and microprinting. For example, some counterfeiters are now using advanced printing techniques to create holograms that look very similar to the real ones at first glance.

Solution: Banks should rely on a combination of visual inspection, technology – based verification, and cross – referencing. By using multiple methods of identification, they can increase the chances of detecting high – quality counterfeits. Additionally, they can collaborate with law enforcement agencies and other relevant organizations to stay informed about the latest high – quality counterfeiting operations and the techniques used.

5. Human Error

Problem: Even well – trained staff may make mistakes during the ID card identification process. This could be due to fatigue, distraction, or simply overlooking a small but important detail. For example, a staff member may fail to notice a slightly misaligned watermark or a small smudge on the card during visual inspection.

Solution: Implement double – checking procedures. Have a second staff member review the ID card and the verification process, especially in cases where there is a suspicion of a fake ID card. Additionally, provide a stress – free work environment and encourage staff to take breaks to reduce the likelihood of errors due to fatigue. Regularly review and audit the ID card identification process to identify and correct any recurring human – error issues.