Insurance companies play a crucial and multi – faceted role in the complex task of identifying fake ID card claims. In the insurance industry, fraud is a significant concern, and fake ID card claims are a part of this broader issue. When a claim is made using what may be a fake ID card, it can have far – reaching consequences for the insurance company, other policyholders, and the overall integrity of the insurance system.

Initial Verification and Data Analysis

One of the first steps insurance companies take in identifying fake ID card claims is initial verification. When a claim is submitted, they start by cross – referencing the information on the ID card with their existing databases. This includes checking details such as the policyholder’s name, date of birth, and policy number. Insurance companies have sophisticated data management systems that store vast amounts of customer information. By running the ID card details through these systems, they can quickly spot any discrepancies. For example, if the name on the ID card does not match the name associated with the policy, or if the date of birth is inconsistent with the records, it could be a red flag for a potential fake ID card claim.

Data analysis also plays a vital role. Insurance companies use advanced algorithms to analyze patterns in claims data. They look at factors such as the frequency of claims from a particular ID number, the types of services or products being claimed, and the geographical location of the claims. If an ID number is associated with an unusually high number of claims in a short period, or if the claims are for very expensive or rare items or services, it may prompt further investigation into the authenticity of the ID card. These algorithms can also detect if there are similarities in claims made by different ID numbers that might indicate a coordinated fraud scheme involving fake ID cards.

Physical Examination of ID Cards

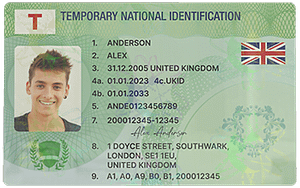

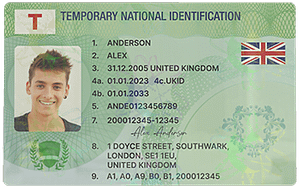

Insurance companies often have trained personnel who are experts in examining the physical characteristics of ID cards. They look for signs of tampering or forgery. Genuine ID cards have specific security features such as holograms, watermarks, and micro – printing. These features are difficult to replicate accurately. For example, a well – trained examiner can spot a hologram that looks off or a watermark that is not in the correct position. They also check the quality of the printing on the ID card. Poor – quality printing, smudged text, or misaligned images can be indicators of a fake ID card. Additionally, the material of the ID card is examined. Real ID cards are made from specific types of plastic or other durable materials, and a fake one may be made from a sub – standard or different material that can be detected through close inspection.

Another aspect of physical examination is checking for signs of alteration. Sometimes, fraudsters may try to modify an existing ID card to make it look like it belongs to someone else. This could involve changing the photo, name, or other details. Insurance company examiners are trained to look for subtle signs of such alterations, such as differences in the texture or color around the modified area, or inconsistencies in the font or formatting of the text.

Communication with Issuing Authorities

When there are doubts about the authenticity of an ID card, insurance companies do not hesitate to communicate with the relevant issuing authorities. For example, if it is a driver’s license being used as an ID for a claim, the insurance company will contact the department of motor vehicles (DMV) in the relevant jurisdiction. They will provide the details of the ID card in question and ask for verification of its authenticity. The DMV has access to its own databases that contain information about issued licenses, including details about the original application, any changes made over time, and the security features of the license. By getting information directly from the issuing authority, insurance companies can confirm whether the ID card is genuine or fake.

Similarly, for other types of ID cards such as government – issued identity cards or employee ID cards, insurance companies will reach out to the appropriate issuing bodies. This communication can also provide additional information about the cardholder, such as their employment status (in the case of an employee ID card) or their citizenship (in the case of a government ID card). This extra information can be crucial in determining the legitimacy of the claim made using the ID card.

Collaboration with Law Enforcement and Other Industry Players

Insurance companies often collaborate with law enforcement agencies when dealing with suspected fake ID card claims. Law enforcement has access to resources and expertise that can be invaluable in uncovering fraud rings and identifying the individuals behind fake ID card usage. For example, the police may have information about known counterfeiters or fraudsters in the area who are involved in making or using fake ID cards. By sharing information with law enforcement, insurance companies can help in the investigation and prosecution of these criminals. In return, law enforcement can assist insurance companies in gathering evidence and conducting raids on locations where fake ID cards may be produced or stored.

Insurance companies also collaborate with other industry players. There are industry – wide databases and information – sharing platforms where insurance companies can report and access information about fake ID card claims and other forms of fraud. By participating in these platforms, they can stay informed about emerging trends in fake ID card usage and share their own experiences. This collaborative approach helps in building a more comprehensive understanding of the problem and developing more effective strategies for identifying and preventing fake ID card claims.

Employee Training and Education

To effectively identify fake ID card claims, insurance companies invest in training and educating their employees. Customer service representatives, claims adjusters, and fraud investigators all need to be well – versed in the signs of fake ID cards. Training programs cover topics such as the physical characteristics of genuine ID cards, how to conduct data analysis for fraud detection, and the proper procedures for communicating with issuing authorities. For example, customer service representatives are trained to ask the right questions when a claim is first reported. They are taught to be vigilant about any suspicious behavior or inconsistent information provided by the claimant. Claims adjusters are trained in more in – depth analysis techniques, such as how to use specialized software to compare ID card details with existing records and how to conduct on – site investigations if necessary.

Continuous education is also important in this field. As fraudsters become more sophisticated in their methods of creating and using fake ID cards, insurance company employees need to stay updated on the latest trends and techniques for detection. This may involve attending industry conferences, participating in online training courses, or engaging in internal knowledge – sharing sessions. By having a well – trained workforce, insurance companies can improve their ability to identify fake ID card claims and protect themselves and their policyholders from fraud.

Common Problems and Solutions

- Problem: Incomplete or Inaccurate Data in Company Databases

Sometimes, the data in an insurance company’s database may be incomplete or inaccurate. This can lead to false positives or false negatives when trying to verify ID card details. For example, if a policyholder’s name has been misspelled in the database, a valid ID card may be flagged as potentially fake.

Solution: Regularly update and maintain databases. Implement data quality control measures such as double – checking new data entries and cross – referencing with external sources. Conduct periodic audits of the database to identify and correct any inaccuracies or missing information.

- Problem: Difficulty in Detecting High – Quality Forgeries

With the advancement of technology, some fake ID cards are of very high quality and can be difficult to distinguish from genuine ones. Fraudsters may use sophisticated printing techniques and materials to create ID cards that closely mimic the real thing.

Solution: Invest in advanced authentication technologies. This could include using ultraviolet scanners to detect hidden security features, or employing machine – learning algorithms that can analyze the minute details of an ID card image to identify forgeries. Also, continuously train employees on the latest forgery techniques and how to spot them.

- Problem: Delays in Communication with Issuing Authorities

When insurance companies contact issuing authorities for ID card verification, there may be delays in getting a response. This can slow down the claims processing and fraud detection process. For example, the issuing authority may be overwhelmed with requests or have inefficient internal processes.

Solution: Establish clear lines of communication and service – level agreements with issuing authorities. Use electronic communication channels whenever possible to speed up the process. Also, maintain a follow – up system to ensure that requests are not forgotten or overlooked.

- Problem: Lack of Cooperation from Other Industry Players

Not all insurance companies or industry players may be willing to share information on fake ID card claims. This can limit the effectiveness of collaborative efforts in fraud detection. Some companies may be worried about sharing sensitive information or may not see the immediate benefit of such cooperation.

Solution: Develop industry – wide standards and incentives for information sharing. Create secure platforms where companies can share information anonymously if necessary. Highlight the long – term benefits of cooperation, such as reduced overall fraud losses for the industry and improved customer trust.

- Problem: Employee Resistance to Training

Some employees may be resistant to training programs, especially if they feel that it is time – consuming or not relevant to their daily work. This can undermine the insurance company’s efforts to have a well – trained workforce for fraud detection.

Solution: Design training programs that are engaging and relevant. Tie training to career development opportunities, such as promotions or bonuses. Use real – life case studies and examples to show employees how their knowledge and skills in fraud detection can make a difference in protecting the company and its customers.